how to lower property taxes in maryland

8 ways to lower your property taxes and get some money back Review your property tax card. 0 of the first 8000 of the.

Property Tax In The United States Wikipedia

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

. As is the case with most states. This detailed report tells you everything you need to know about reduc. For business tax liabilities call 410-767-1601.

Thus for illustration purposes only the county and state property tax rates will be considered here. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula. Maryland Income Tax Calculator 2021.

Using an effective tax rate of 108 per 100 for this example 100 local property tax plus 08 state property tax the amount of property taxes due would be calculated like this. Get a copy of your property tax card from the local assessors office. How can I lower my property taxes in Maryland.

The rates are based on 100 of assessed. For more information please call 410-996-2760 or email at sdatperspropmarylandgov. Tax rates in the county are roughly.

To change your mailing address on the Real Property File for tax bills you should send a written request to the Citys Department of Transportation Property Location Section 401 E Fayette. Subsequently Maryland has the 24th highest property tax rate in the country. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612.

This detailed report tells you everything you need to know about reduc. Understand Your Tax Bill If you feel you are paying too much its. If you have questions please contact.

The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the. Downloadable applications are available for most credits and programs. While the state government handles property assessments in Maryland local governments still set their own tax rates.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. Tail the property tax assessorGoing through the house with the assessor will allow you to see if they are doing their job properly Check the tax bill for mistakesNoticing inaccuracies on your. Lowest Property Tax Highest Property Tax No Tax Data Maryland Property Taxes Go To Different State 277400 Avg.

Tax rates are set by the County Council each fiscal year. The average property tax bill in Maryland ranges between 1403 and 5389. 087 of home value Tax amount varies by county The median.

Your average tax rate is 1198 and your marginal. Homeowners In Maryland Can Claim Deductions On Their Property Taxes Maryland has a number of tax deductions for property owners. Maryland Property Tax Rates.

Learn more about each tax credit or tax relief program below. If your name appears in the listing you should contact the Comptrollers Office to make arrangements to resolve the liability. Our example will use a typical county rate of 100 per 100 of assessment.

Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill.

Property Tax Exemptions And Payments In Lieu Of Taxes Local Revenue Effects Conduit Street

Your Guide To Maryland Real Estate Taxes Upnest

How Taxes On Property Owned In Another State Work For 2022

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Maryland Llc Annual Report Personal Property Tax Youtube

Is The County Council Sneaking In A Tax Hike Seventh State

Maryland Business Personal Property Tax A Guide

Maryland Business Personal Property Tax A Guide

Property Tax Faqs Talbot County Maryland

Deducting Property Taxes H R Block

Maryland Sales Tax Handbook 2022

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

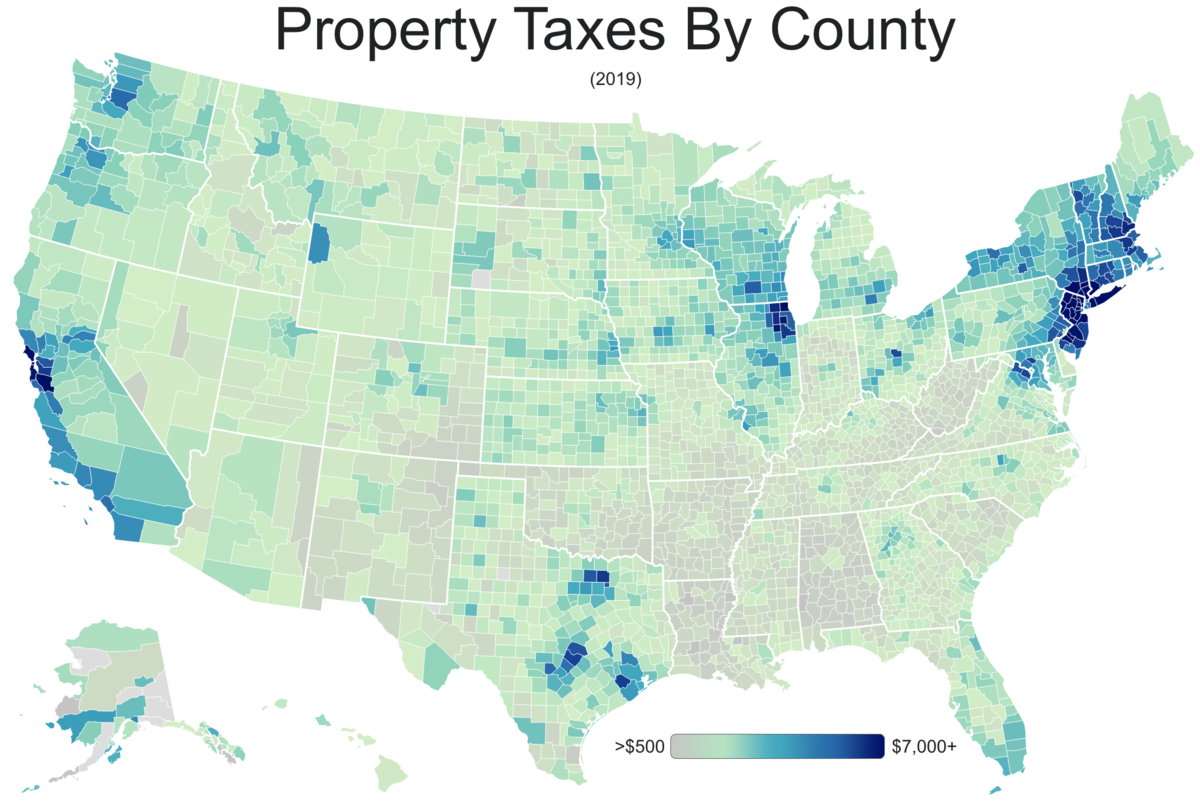

Property Taxes By County Interactive Map Tax Foundation

Freedom In The 50 States 2021 Maryland Overall Freedom Cato Institute

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group